|

A portfolio is a combination of different investment assets mixed and matched for the purpose of achieving an investor's goal(s). Items that are considered a part of your portfolio can include any asset you own--from real items such as art and real estate, to equities, fixed-income instruments, and cash and equivalents. For the purpose of this section, we will focus on the most liquid asset types: equities, fixed-income securities, and cash and equivalents.

| Basic Types of Portfolios |

In general, aggressive investment strategies--those that shoot for the highest possible return--are most appropriate for investors who, for the sake of this potential high return, have a high risk tolerance (can stomach wide fluctuations in value) and a longer time horizon. Aggressive portfolios generally have a higher investment in equities.

The conservative investment strategies, which put safety at a high priority, are most appropriate for investors who have a lower risk tolerance and shorter time horizon. Conservative portfolios will generally consist mainly of cash and cash equivalents, or high-quality fixed-income instruments.

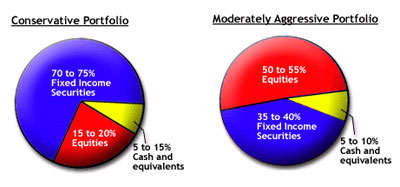

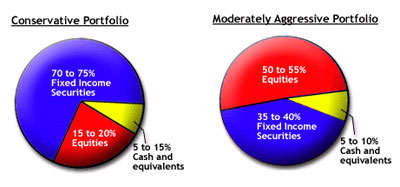

To demonstrate the types of allocations that are suitable for these strategies, we'll look at samples of both a conservative and a moderately aggressive portfolio.

(Note that the terms "cash" and the "money market" refer to any short-term, fixed-income investment.)

Conservative Portfolio Characteristics:

Maintain real portfolio value i.e. protect against inflation

Generate high current income and yield long-term capital growth through

investment in equities.

Medium term investment horizon (2-3 years)

Low risk tolerance

Moderately Aggressive Portfolio Characteristics

Primary objective is to look for capital growth through equity investments

Secondary objective would be to provide stability in portfolio value by investing 35-40 % in fixed income securities thereby limiting down-side risk (risk of capital erosion)

Investment horizon of 4 years or more

Medium to high-risk tolerance

It all centers around the concept of diversification. Since different securities perform differently at different points in time, a mix of assets and securities limits the downside of any investments. By investing in both stocks and bonds for example, the loss caused due to a possible fall in stock prices is limited by the stability offered by bonds and therefore extent of loss is minimized.

There have been all sorts of academic studies and formulas that demonstrate why diversification is important, but it's really just the simple practice of "not putting all your eggs in one basket." If you spread your investments across various types of assets and markets, you'll reduce the risk of catastrophic financial losses.

|